The sports drink market is no longer defined solely by electrolytes and carbohydrates. In recent years, CBD-infused sports drinks have entered the conversation—targeting recovery, stress relief, and performance balance. As investors and retailers evaluate future potential, two distinct growth trajectories are emerging: one grounded in stability and scale, the other fueled by innovation and high-margin curiosity.

The Established Power of Isotonic Drinks

Traditional isotonic beverages, long led by global brands like Gatorade, Powerade, and Lucozade, remain the backbone of the sports hydration industry. They’re trusted, widely distributed, and continuously refreshed through new low-sugar and natural formulations. In 2023, the global sports drink market was valued at roughly $38–39 billion, with analysts projecting it to reach nearly $69 billion by 2030—a steady annual growth rate of around 7–8%.

Within that category, isotonic drinks specifically are forecasted to grow from about $17.2 billion in 2025 to $21.8 billion by 2030, representing a 4.9% CAGR. This growth is driven by consistent consumer demand among athletes, gym-goers, and outdoor enthusiasts who rely on hydration and electrolyte balance during physical activity. Even as the segment matures, reformulations focusing on reduced sugar, natural flavors, and sustainable packaging keep it relevant and profitable.

The Rapid Rise of CBD Sports Beverages

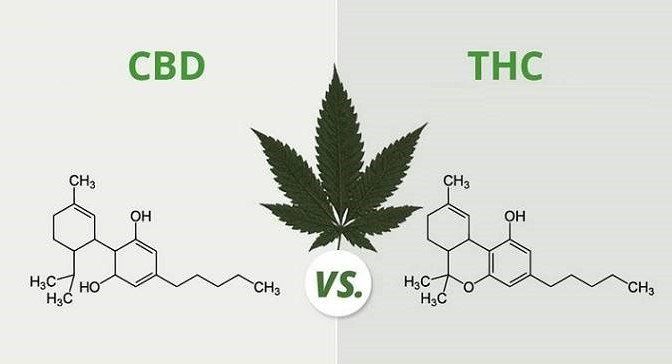

CBD sports drinks, on the other hand, are still defining their category. Built around wellness and recovery rather than raw energy, these products merge the calming, anti-inflammatory potential of cannabidiol with hydration and nutrient replenishment. Global forecasts for the broader CBD beverage market show growth from approximately $1.1 billion in 2023 to $3.8 billion by 2030, translating to a high-teens CAGR—significantly steeper than isotonic growth.

Consumer awareness and athlete endorsements are accelerating this segment. Users cite benefits like reduced muscle soreness, enhanced relaxation, and mental clarity post-exercise. Brands such as Kill Cliff, Recess, and CENTR are already leveraging clean ingredients and stress-relief narratives to appeal to fitness enthusiasts seeking a modern alternative to caffeine-heavy recovery drinks.

However, regulatory uncertainty remains the major barrier. The FDA has yet to establish a clear framework for CBD as a food or beverage additive, which keeps many mainstream beverage companies on the sidelines. Without national approval, large-scale retail expansion is limited, confining most CBD sports drinks to e-commerce, boutique fitness centers, and wellness retailers.

Market Comparison and Future Outlook

Traditional isotonic drinks are reliable performers: global presence, category maturity, and mass retail penetration ensure consistent volume growth. In contrast, CBD sports drinks offer high growth potential from a small base, but face obstacles in compliance, labeling, and distribution.

Between now and 2030, isotonic drinks will likely continue compounding around 5–7% annually, driven by global fitness culture and product evolution. CBD sports beverages could exceed 15–18% CAGR, contingent on regulatory progress and consumer education.

For investors and beverage strategists, the takeaway is clear: isotonic drinks deliver predictable strength, while CBD sports drinks represent speculative upside tied to wellness trends and policy reform. The next five years will determine whether CBD hydration transitions from niche innovation to mainstream competitor—or remains a premium supplement to the isotonic empire.